Our private equity investments focus on companies that are ten to seventy-five years old, have a long history of both revenues and profitability and give us the safest opportunity to grow investors’ money.

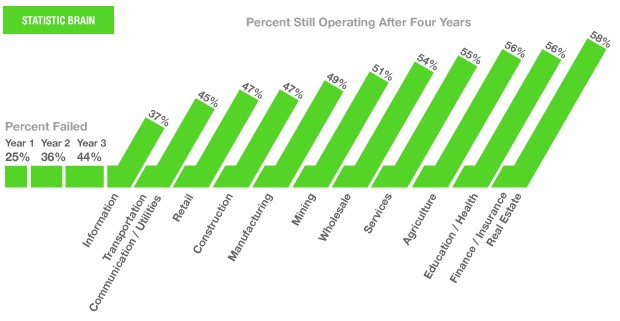

When we buy a profitable company we are already far ahead of the 44% of startup companies that don’t make it to year four.

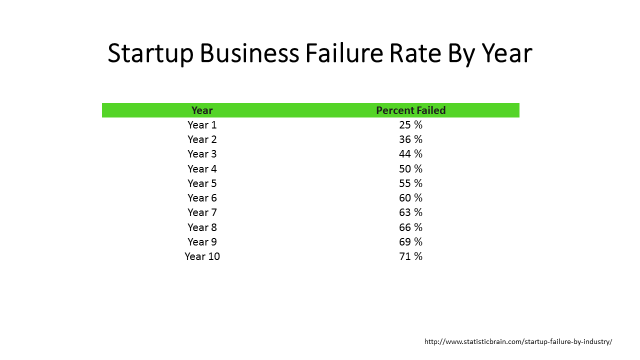

If we look at the ten-year record for startup companies, you find the following success rates

.

Now if we also apply “profitability” to the survival statistics noted above, there is an even stronger case for why it is a far safer for investors to invest in established companies. The vast majority of startups focus on rapidly growing revenue with the hopes that a bigger fish will buy them out and the investors can cash in. With our acquisitions we provide investors not only long-term capital gains as we grow the value of the companies we purchase, but our portfolio companies also distribute annual profit sharing. We like to see investors get all of their investment back in five years through distributions of profit sharing. This simply does not occur with investment in startup companies.

Contact us if you’d like to learn more about our investment approach and criteria, we’d be happy to share our experiences with you.

0 Comments